Double-digit gains among equity hedge funds have helped drive the broader hedge fund industry to its strongest annual performance in three years.

New data published by Hedge Fund Research shows equity hedge, event-driven, macro and relative value arbitrage funds all delivered positive annual returns for investors, with stock picking strategies leading the way in 2024.

HFR’s main Fund Weighted Composite Index, which offers a snapshot of the broader hedge fund industry’s performance, ended the year up 10.01%.

The double-digit advance was the index’s best annual performance since 2021, when it notched a 10.16% return. The benchmark – which tracks the performances of some 1,400 single manager strategies across all hedge fund strategies globally – dipped slightly in December, losing 0.19%, having earlier risen 2.58% in November amid the post-election market surge.

Tech triumph

“Hedge funds gained to conclude a volatile and uncertain 2024, navigating a very different market environment than the election-euphoric, risk-on sentiment that dominated November,” said HFR president Kenneth Heinz, noting the equities decline and rise in bond yields last month, with ongoing inflationary pressures cooling rate cuts expectations.

Yet despite dipping 0.74% during December, equity hedge funds were up 12.3% for the year, as stock-pickers capitalized on 2024’s continued tech-fuelled market rally and November’s post-election bounce.

Technology-focused equity hedge funds fared best, notching a near-20% annual gain, while computer-based quant equities soared to an 18.53% return. Fundamental growth (12.9%), multi-strategy equity (12.1%), fundamental value (11.5%), and equity market neutral (10.12%) strategies all advanced into double-digit territory for the year, with healthcare hedge funds (9.76%) and energy-focused managers (9.47%) close behind.

Among the big winners in the equity hedge fund space were Tiger Global, which delivered an eye-catching 23.8% return, and Renaissance Capital’s quant equity Renaissance Institutional Equities Fund, which ended the year up 22.7%, according to Bloomberg data.

Standout performances

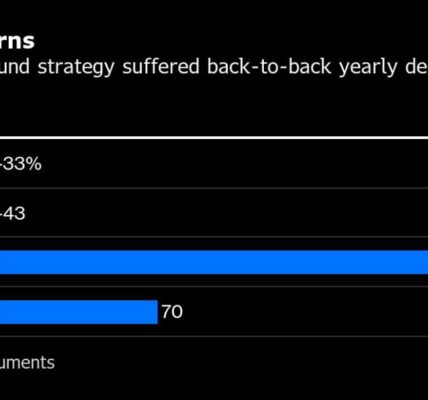

Meanwhile, global macro hedge funds – which earlier suffered four consecutive down months between May and August – closed out 2024 with back-to-back gains in November and December to put them up almost 6% for the year.

The best-performing sub-strategies included multi-strategy macro, discretionary thematic, and active trading – all up more than 7% for the year – and commodities-focused macro funds, which gained 6.6% annually.

Macro managers, which bet on macroeconomic and geopolitical trends using equities, bonds, currencies, commodities and other assets, delivered an industry-leading 1.11% monthly return in December as equities and bonds declined on expectations for fewer rate cuts by the U.S. Federal Reserve in 2025.

While many macro managers were frequently wrongfooted by geopolitical and interest rate uncertainty throughout the year, 2024 still yielded some standout performances: D.E. Shaw’s macro-focused multi-strat fund Oculus notched its biggest ever annual return, surging 36% annually, while Rokos Capital Management, the London-based outfit led by Brevan Howard founding partner Chris Rokos, rose 30.7%.

Landmark launches

Event-driven hedge funds – which trade out-of-favor, deep value and often heavily-shorted equity and credit positions using catalyst, M&A and activist approaches – generated 8.73% for the year, despite falling 1.27% in December. Event-driven multi-strategy funds led the way with a 12.6% return, as credit arbitrage funds (10.33%) and managers running distressed/restructuring strategies (10.48%) also ended the year in double-digit territory.

Fixed income-based interest rate-sensitive relative value managers added 8.61% in 2024, powered by strong gains among convertible arbitrage-focused hedge funds, which surged 11.14%, as well as asset-backed, corporates and sovereign-focused strategies, each up more than 9%.

Overall, some 45% of hedge funds tracked by Chicago-based HFR delivered positive performances in December, down from 75% in November. The top decile of managers in its Fund Weighted Composite index gained an average 37.3% for the year in 2024, while the bottom decile declined 11.7% – a top-to-bottom dispersion of 49%.

Elsewhere, HFR noted how the number of new hedge fund launches reached some 375 in the first three quarters of 2024, up on the previous year’s figure. The estimated number of new funds launched in Q3 rose to 118, up from the previous quarter’s 111, while closures in Q3 stood at just 82, the lowest quarterly liquidation total since Q2 2006.

2024’s landmark launches included Jain Global, Bobby Jain’s multi-strategy fund, at $5.3 billion, and Diego Megia’s $5 billion global macro-focused Taula Capital.

Overall, total global hedge fund industry capital hit another all-time high heading into the final quarter of the year, at an estimated $4.46 trillion.