(Bloomberg) — The euro has kicked off the year on a grim note, and hedge funds see it hurtling toward parity with the dollar — if not lower — in the coming months.

Most Read from Bloomberg

Leveraged funds in Europe and the US rolled down their euro options positions on Thursday as the currency dropped to its lowest level since November 2022, traders said. Some 2.5 billion euro options wagers with strikes targeting parity and below changed hands on Thursday — about four times last month’s daily average, according to Bloomberg’s calculations based on Depository Trust and Clearing Corporation data.

The euro has declined about 1.5% this week to trail all but one of its Group-of-10 peers as jitters about Europe’s economic growth outlook and the prospect of more US tariffs rattled investors. Selling momentum may gain traction if the region’s growth prospects weaken further, with the common currency ranking among the most liquid assets to trade.

“The balance of risks are indeed skewed toward the downside for euro, especially as those option barriers around 1.03 levels were taken out,” said Christopher Wong, strategist at Oversea-Chinese Banking Corp. “Growth momentum in the euro area is already slowing, adding to expectations that the European Central Bank may need to cut more or cut deeper to support growth.”

The euro traded at around $1.0274 on Friday, after plummeting over 1% to $1.0226 in the previous session, a level last reached more than two years ago.

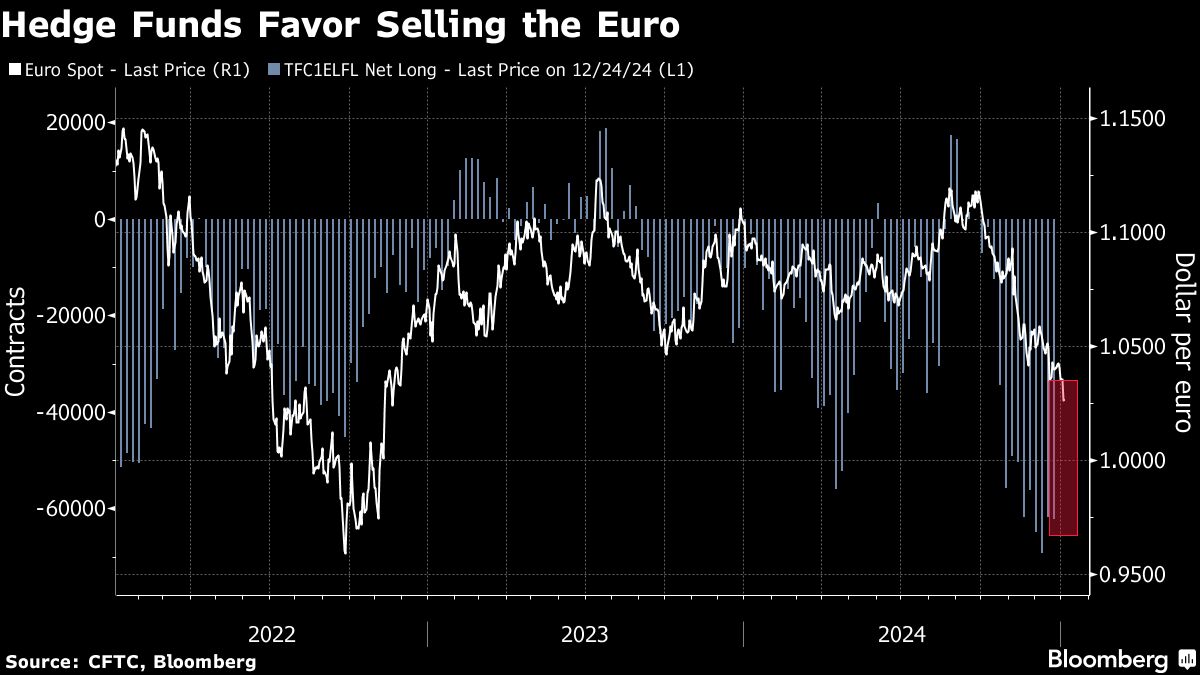

The negative sentiment has been building for a while, with hedge funds having held bearish positions on the common currency since late September, according to Commodity Futures Trading Commission data. Asset managers have also pared bullish bets.

What Bloomberg Strategists Say…

“EUR/USD’s path below parity is becoming clearer as big option positioning adds to negative momentum in the spot rate.”

Mark Cranfield, Markets Live strategist

Rabobank, Wells Fargo and Investec see potential for the euro to test parity versus the dollar in the second quarter. The key level was last breached in 2022 after Russia’s invasion of Ukraine triggered an energy crisis in Europe and ignited fears of a slowdown.

“Strategically, we stay bearish euro-dollar, targeting parity over the medium term,” Mohamad Al-Saraf, analyst at Danske Bank in Copenhagen, wrote in a note.