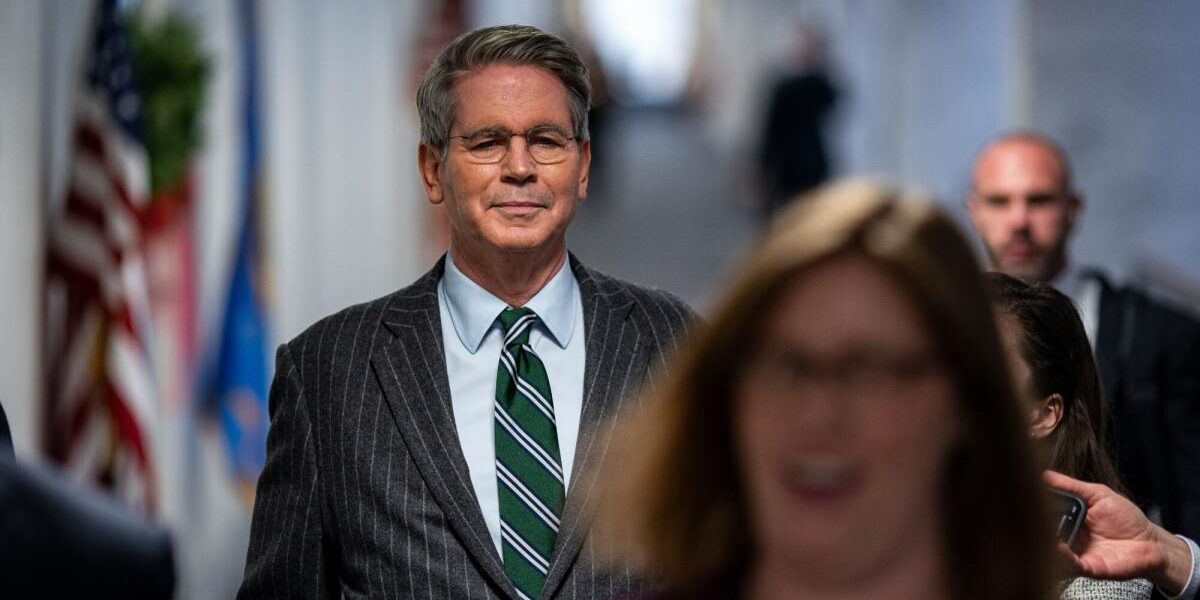

(Bloomberg) — Scott Bessent, President-elect Donald Trump’s pick to run the US Treasury Department, will resign from Key Square Group and sell his share of the partnership to avoid conflicts of interest if confirmed by the Senate.

Most Read from Bloomberg

The resignation would immediately follow his confirmation as Treasury secretary, according to a document released by the US Office of Government Ethics. He’d sell his interest in Key Square Group, the macro hedge fund he founded and led, within 90 days after winning Senate approval.

High-ranking government officials are required to disclose their holdings and plans to divest those that could pose conflicts prior to confirmation by the Senate, which will hold a hearing for Bessent on Thursday.

The hedge fund manager disclosed assets worth at least $521 million in his personal financial disclosure, also made public Saturday by OGE, though his portfolio is almost certainly worth much more. Nominees list the value of their assets within broad ranges, topped at “over $50,000,000.”

Bessent listed nine assets in the highest range, all tied to his hedge fund. They included two tranches of US Treasury bills, two Invesco funds and open positions on the dollar’s value relative to foreign currencies.

He also listed a personal investment, worth no more than $500,000, in an iShares exchange traded fund tied to the price of Bitcoin. Like his assets held through Key Square Capital, Bessent will divest the crypto-based ETF. Key Square Group would be wound down at the end of March, according to his disclosure.

As Treasury secretary, Bessent will play a key role in everything from Trump’s tax plans to the regulation of digital assets. A proponent of realigning US currency policy, Bessent has stopped short of supporting an overt strategy of depreciating the dollar. During Trump’s first term, the then-president called out dollar appreciation for being harmful to US manufacturers and considered government intervention to manage the greenback’s value.

Some of Bessent’s potential conflicts will take longer to resolve. He has invested at least $250,000 in three funds that allow him to withdraw no more than 25% of his holdings each quarter. He wouldn’t be able to completely divest his holdings until late September, much longer than the typical 90-day disclosure window. Bessent said he’d recuse himself from specific decisions that would have a predictable effect on their value.