(Bloomberg) — Millennium Management spinoff Modular Asset Management plans to expand to Hong Kong, the latest hedge fund arrival as the city tries to defend its status as a global financial hub.

Most Read from Bloomberg

Singapore-based Modular, which manages $1.5 billion and focuses on macro bets, has brought in former Barclays Plc trader Alex Hu Xiuyi as a portfolio manager. Hu is its first hire for Hong Kong, where the firm is looking to open an office in the second quarter, said a person with knowledge of the matter.

The Hong Kong office will allow the firm to stay closer to the China market and attract investment staff who wish to stay in the city, said the person, who asked not to be identified discussing private information. Chief Operating Officer Matthew Cannon declined to comment.

The expansion comes as Hong Kong gets squeezed by geopolitical spats and China’s economic slowdown. Growing tensions between the US and China are polarizing the global economy with ramifications for markets that macro hedge funds dabble in: equities, fixed income, currencies and commodities.

A few days into the new year, the outgoing Biden administration added Tencent Holdings Ltd., the world’s largest gaming publisher, and Contemporary Amperex Technology Co., a key battery supplier to Tesla Inc., to its list of companies allegedly working with China’s military.

The Chinese central bank has ramped up bill auctions in Hong Kong to the largest on record to support the yuan on the cusp of the second presidency of Donald Trump. On the campaign trail, Trump described “tariff” as his favorite word in the dictionary and threatened to slap up to 60% import duties on Chinese goods.

Facing rivalries from Singapore to Tokyo and Middle Eastern cities, Hong Kong officials have been trying to burnish the city’s appeal to financial firms after a bruising talent drain during the years of the Covid pandemic, China’s crackdown on various industries and mounting geopolitical tensions.

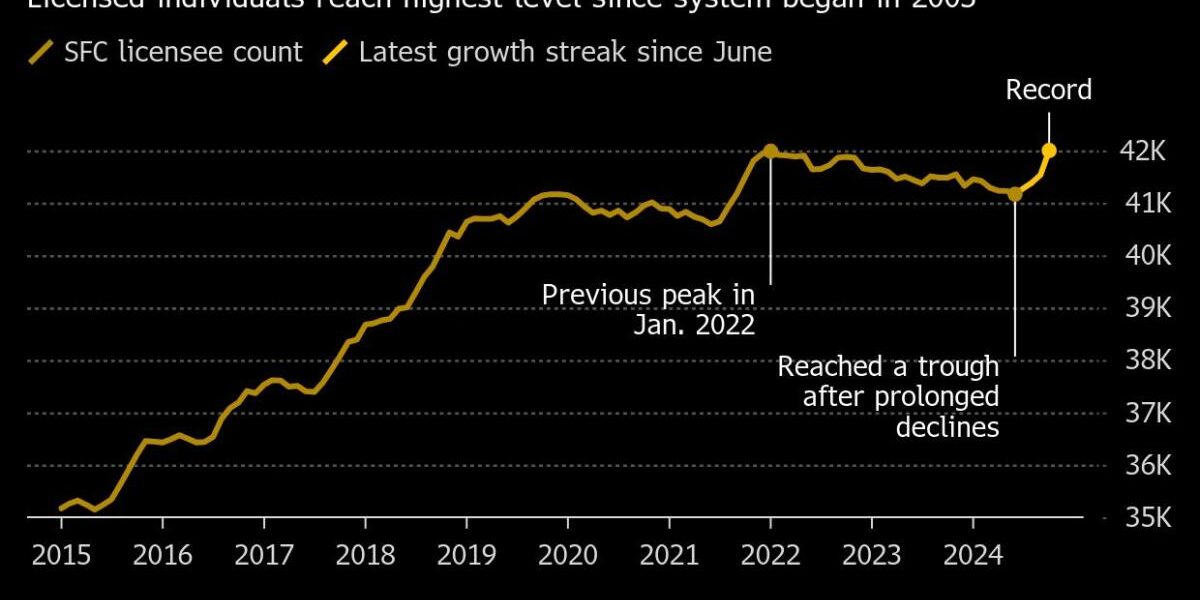

Some positive signs have emerged. In the four months to October, the number of financial professionals newly licensed by the city’s securities watchdog saw a net increase of about 830, driving the total licensees to a record 42,000, according to a Bloomberg News analysis based on regulatory data.

Other recent international hedge fund arrivals in Hong Kong include New York-based multistrategy firm Jain Global LLC and Arrowpoint Investment Partners, led by Singapore-based Jonathan Xiong.