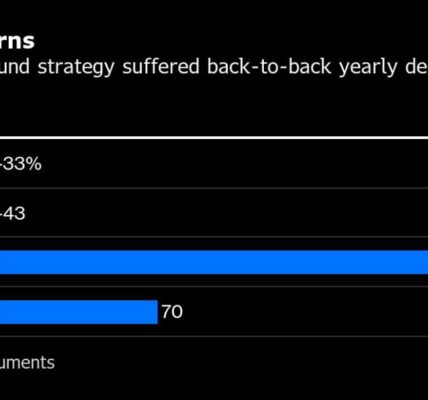

The Nancy Pelosi Stock Tracker account on X.com, formerly Twitter, recently posted that the California Representative’s investment portfolio returned 54% in 2024, beating the popular Inverse Cramer account’s 43% gains to become the top portfolio on the Autopilot investment app.

The team behind the Pelosi tracker account created Autopilot. It helps investors mimic the trades of popular hedge fund managers and politicians.

Pelosi’s portfolio gains also beat top hedge funds, which spend vast amounts of money hiring top quantitative analysts and data scientists to build leading AI and machine learning models to maximise profits.

For instance, Pelosi’s 54% investment gains beat Discovery Capital Management’s 52%, PointState’s 47.9%, Contour’s 47.8%, DE Shaw Oculus’ 36.1%, and Bridgewater China’s 35% profits for 2024.

Timing The Market Better Than AI Trading Systems

It is estimated that Nancy Pelosi’s investments have returned over 700% since 2014. The former House Speaker’s husband, Paul, an investment banker, makes the trades on her behalf.

Over the years, the couple has faced growing criticism that Nancy shares confidential market information with Paul that can influence markets.

However, the politician has refuted the claims and even supported the ETHICS Act introduced by bipartisan senators last year to ban Congressional traders.

Despite these bills and public outcry to prevent insider trading, Paul continues to make trades that result in huge profits or help avoid massive losses.

Pelosi’s Top Stock Trades Of The Decade

Pelosi sold 5,000 Microsoft (NASDAQ: MSFT) in late July of 2024, worth more than $2.1 million, marking her largest portfolio sell in two years.

The trade was executed within two weeks of the Crowdstrike security incident, which affected millions of devices running Microsoft Windows systems. Pelosi also avoided further investment losses when MSFT stock faced volatility after the Federal Trade Commission launched a major antitrust investigation into the company in late November last year. The Commission is looking into MSFT’s cloud computing, software licensing, and company-wide business practices.

In November 2023, Pelosi purchased 50 Nvidia (NASDAQ: NVDA) call options with a strike price of $120 and a December 2024 expiry. The move took place months before Nvidia’s 10-for-1 stock split.

In June 2024, Pelosi bought 20 Broadcom (NASDAQ: AVGO) call options with a $800 strike price and an expiry date of June 2025. The trade took place a month before Broadcom executed a 10-for-1 stock split.

In July 2024, the Congress member sold 2,000 Visa Inc. (NYSE: V) shares worth over $500,000. The trade occurred three months before the US Department of Justice filed a civil antitrust lawsuit against the payments giant, accusing it of unlawfully monopolising the debit card market.

Is Tracking Congressional Trades A Good Idea?

Copying Congressional trades can be very profitable. However, the reporting lag between the trade disclosure date and the execution date poses a challenge for investors.

Congress members have 45 days to report trades but can also opt for a 90-day extension. However, some popular alternate data platforms are addressing the reporting lag by devising investment strategies based on when Congressional trades are publicly disclosed.

These emerging platforms also tend to avoid highly overvalued stocks and investment instruments like options to reduce portfolio volatility.

Investors interested in mirroring Congressional trades can partner with a fiduciary financial adviser to hedge risks, especially when your portfolio tracks high-growth or volatile stocks. Fiduciary financial advisers are legally mandated to work in your best interests.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn’t indicate future returns.