Despite charging exorbitant fees for their investment expertise, a majority of hedge funds failed to beat the returns of the benchmark S&P 500 index in 2024.

Don’t Miss Our New Year’s Offers:

U.S. markets experienced a raging bull market last year, with the S&P 500 rising 23%, the second consecutive year in which the benchmark index gained more than 20%. Yet despite the strong market, most hedge funds underperformed in 2024.

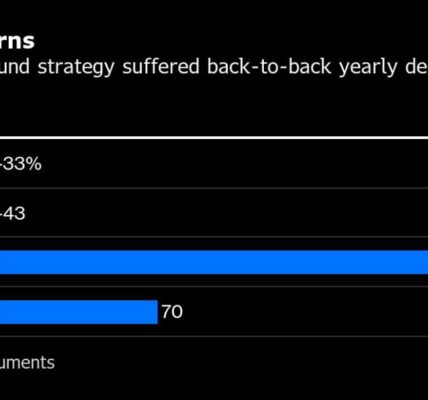

Poor Results

The largest hedge fund in the world, U.S.-based Bridgewater Associates, saw its flagship Pure Alpha fund gain 11% in 2024, less than half the S&P 500’s gain on the year. Similarly, leading hedge fund Citadel, which is run by billionaire investor Ken Griffin, saw its flagship Wellington fund post a 15% gain in 2024.

The Millennium Management fund also returned 15% to investors last year, while British hedge fund Marshall Wace, which manages more than $70 billion of investor capital, returned 14% through its Eureka fund last year.

Tracking the S&P 500

Investors who placed their money in a low cost exchange-traded fund (ETF) that tracks the S&P 500 index would have enjoyed better returns in 2024 than from placing money with a hedge fund. This despite the fact that hedge funds trade several different asset classes, including stocks, bonds and commodities, and often rely on high-frequency trading systems and algorithms.

Hedge funds charge exorbitant fees despite their underperformance. In the U.S., hedge funds typically charge their clients two fees: a management fee that is generally 2% of assets under management and a performance fee that is 20% of a fund’s growth.

Is The SPY ETF a Buy?

As most hedge funds are privately held, we look instead at whether the SPDR S&P 500 ETF Trust (SPY), which tracks the performance of the benchmark S&P 500 index, is a buy or not. The SPY ETF has a consensus Moderate Buy rating among 504 Wall Street analysts. That rating is based on 399 Buy, 99 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $669.60 implies 14.53% upside from current levels.

Read more analyst ratings on the SPY ETF